Hello, Trade The Times family!

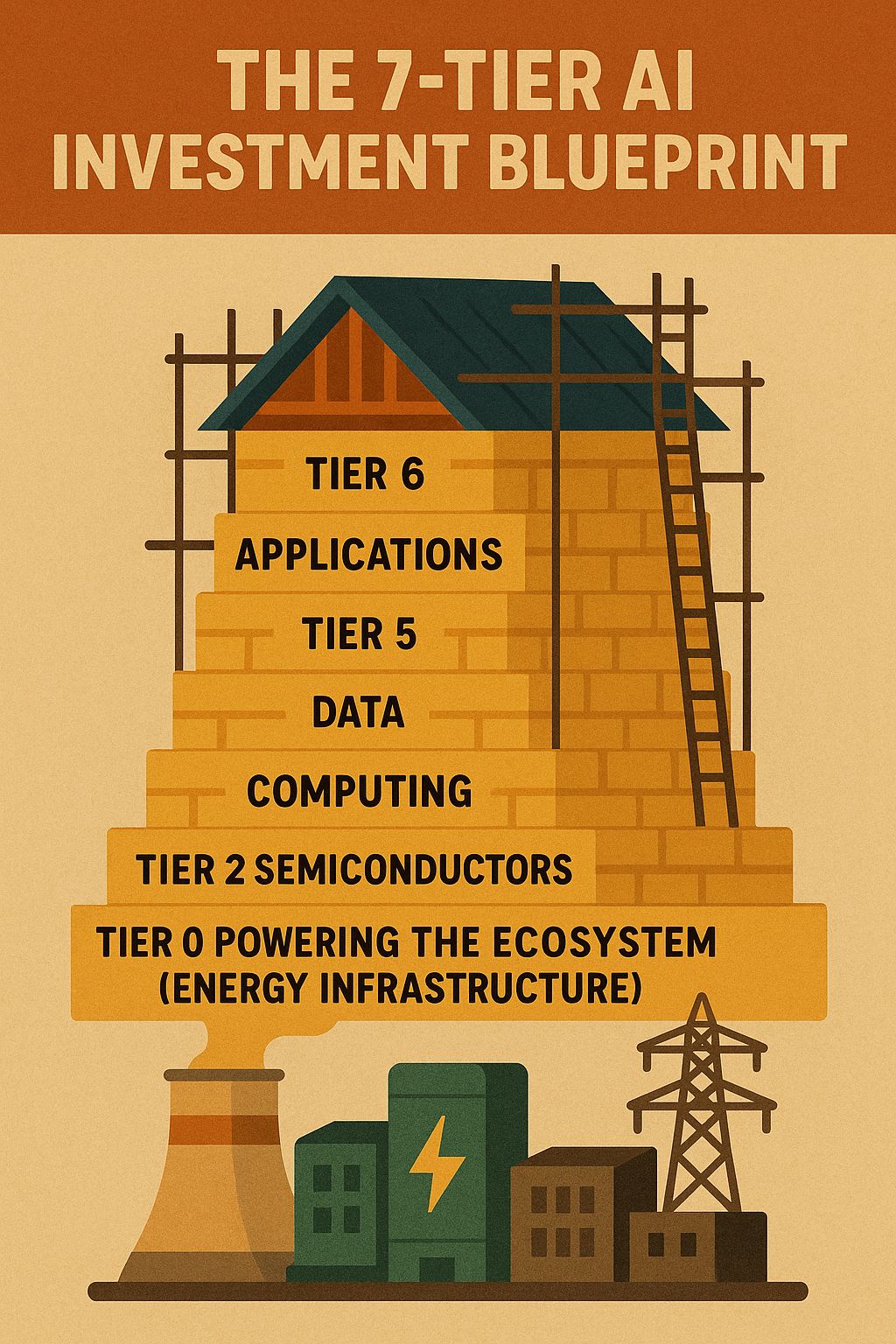

Artificial intelligence is more than just a buzzword—it’s the engine driving tomorrow’s market moves. Whether you’re starting out or optimizing your portfolio, our team has unpacked the “7 Tier Framework” to help you navigate the AI investing world with confidence and clarity.

Why AI Belongs on Your Radar

AI is predicted to grow into a multi-trillion dollar industry in less than a decade, outpacing entire national economies. This revolution is opening doors for investors across the board—from energy suppliers powering data centers to established companies integrating AI to increase profits. At Trade The Times, we’re committed to guiding you to the best research and most practical strategies for this fast-evolving market.

Before we move ahead on the AI Investing Blueprint, we would like to thank our sponsor for this edition.

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

The 7-Tier AI Investment Blueprint

Think of AI investments like constructing a house: Each layer is vital. Here’s how we break it down:

Tier 0 – Powering the Ecosystem (Energy Infrastructure)

Top Picks:

Constellation Energy (CEG): America’s leader in nuclear energy, running nonstop for data centers.

Vertive Holdings (VRT): Essential for data center cooling, partnering with industry giants.

ETF Option: XLU (for broad utility exposure).

Why it matters: Every AI model needs reliable energy. Energy stocks benefit whichever AI firm leads.

Tier 1 – Semiconductor Muscle

Leading Companies: Nvidia (NVDA), AMD, TSMC.

Industry Insight: Nvidia alone claims over 90% AI chip market share. TSMC is the “factory” for nearly all big brands.

In the news: Semiconductors are volatile, but they are the backbone of all AI growth.

Tier 2 – The Digital Warehouse (Data Centers)

Best Bets: Equinix (EQIX), Digital Realty Trust (DLR).

ETF: DTCR covers a range of data center operators.

Key takeaway: Data centers sign long leases—offering stability and dividends, albeit interest rate sensitive.

Tier 3 – The Architects (Foundation Models)

Major Players: Google (GOOGL), Microsoft (MSFT), Meta (META).

Why care: These giants dominate AI R&D and integrate capabilities into widely used products.

Market note: Listed stocks here offer both innovation exposure and business stability.

Tier 4 – Plumbing & Electrical: Software Infrastructure

Highlight: Palantir (PLTR)—empowers institutions with big-data analytics and AI deployment.

Caution: As big tech builds their own infrastructure solutions, niche players face competition.

Tier 5 – The Furniture: AI Applications

Public Picks: SoundHound (SOUN), Adobe (ADBE), Salesforce (CRM).

What’s next: Most breakthrough apps are private—for now. Public options bring AI into products we already know.

Risk & reward: Adobe and Salesforce offer safety, SoundHound is speculative.

Tier 6 – Old Houses, New Tricks (Traditional Firms Adopting AI)

Examples: Rockwell Automation (ROK), Walmart, major banks.

Opportunity: Lower-risk exposure; these firms use AI to boost margins on proven businesses.

Portfolio Structuring: Guideposts from the Trade The Times Team

Conservative: Choose energy, utilities, and data centers; rely on ETFs for stability.

Balanced: Combine big tech leaders, semiconductor companies, and one or two AI-centric ETFs.

Aggressive: Focus on individual winners in chips and applications; these stocks promise growth but ride big swings.

Smart Moves for All Ages

Diversify—don’t put all your money into one idea; today’s tech star could fade tomorrow.

Use dollar-cost averaging to even out volatile price swings.

Always have liquid reserves and avoid using leverage.

Stay informed—the pace in AI is relentless. We recommend revisiting your research quarterly.

Seek professional advice for major decisions, especially if investing a significant share of your wealth.

Risks in Focus

High valuations could see corrections; don’t chase hypes blindly.

Big tech faces regulatory crackdowns.

Technological disruption is always around the corner—winners change fast.

Final Thoughts: Your Action Plan

Our analysts at Trade The Times believe AI offers enormous potential, regardless of your investment style. Success isn’t about predicting every headline—it’s about methodically building skills, diversifying smartly, and staying nimble as new opportunities arise.

We encourage every reader to treat this as a starting point to their own research, and connect with our community to discuss strategies, share updates, and learn together.

Questions or insights? Hit reply or join our next webinar on emerging tech portfolios!