CrowdStrike built its reputation on protecting companies from hackers. Its cloud-based Falcon platform became the gold standard, growing revenue 68% annually over a decade and reaching $1.17 billion in quarterly sales.

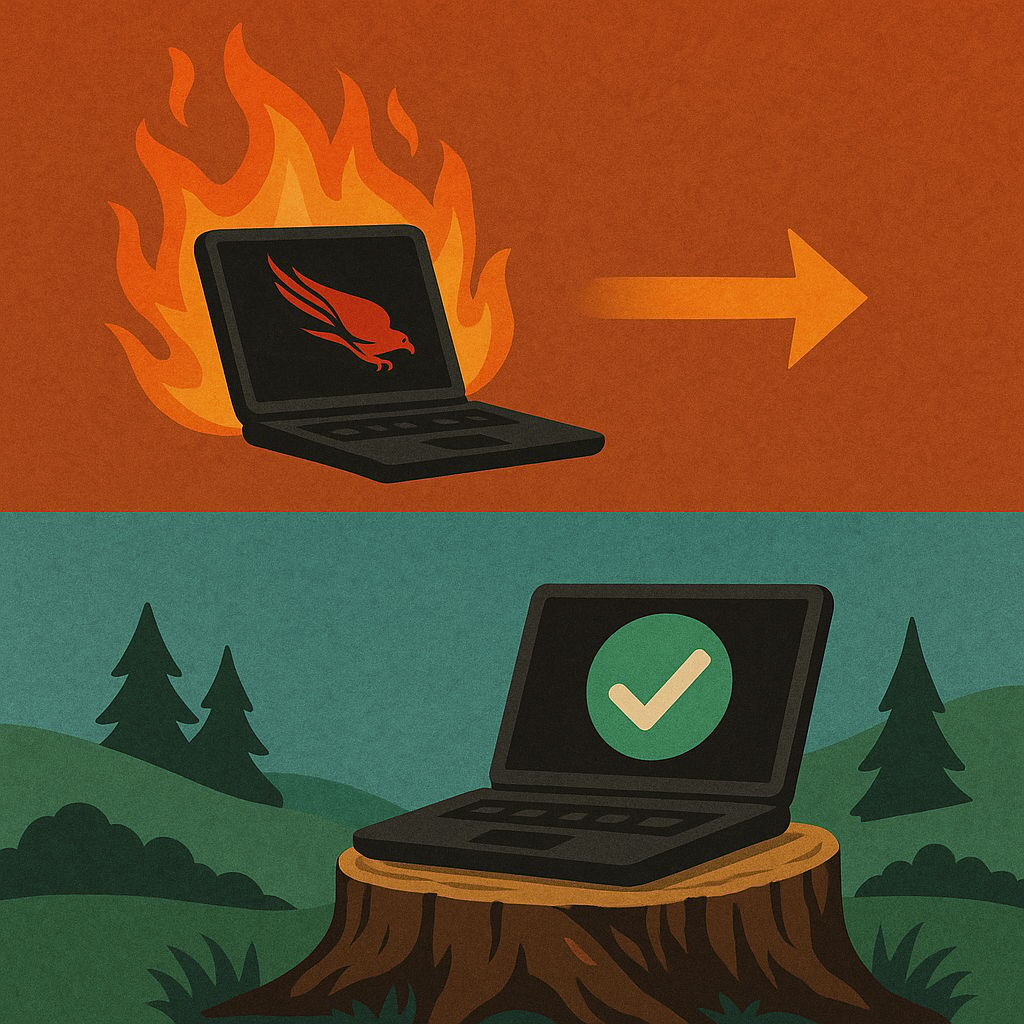

Then came July 2024. A buggy software update crashed 8.5 million Windows computers worldwide—grounding flights, shutting hospitals, freezing retailers. Delta Airlines alone lost over $500 million. The "cybersecurity leader" had accidentally created the very chaos it promises to prevent.

Yet here's what's wild: the stock recovered. CrowdStrike now trades at $470 with a forward P/E of 125x—five times higher than most software companies. Bulls see an AI-powered future where every digital agent needs a security guard. Bears see a bloated valuation one misstep away from collapse. Even Morgan Stanley, after raising their target, downgraded the stock, saying it's "fully valued."

Before we move ahead, we would like to thank our sponsor for this edition

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Why This Matters

CrowdStrike's story isn't just about cybersecurity—it's about whether AI hype justifies paying 125 times future profits.

From hero to villain to hero: Survived reputation-crushing outage, now targeting AI security

From endpoint protection to everything: Expanding into identity, cloud, and AI agent protection

From growth darling to expensive gamble: Trading at 26x sales while posting net losses

The big question: Is this the essential platform protecting the AI revolution—or a dangerously overpriced stock ignoring fundamental risks?

The Roundtable Debate

Opening Shots

Morgan Stanley Analyst (Major Investment Bank — Downgrade to Equal Weight): "We're raising our price target to $495 but downgrading to neutral. Shares ran up 50% since April, and the expected second-half acceleration is fully priced in. Long-term story remains compelling, but there's no value left at current levels."

Dair Sansyzbayev (9.6K Followers, Institutional Finance — Strong Buy): "Everyone's missing the AI transformation. CrowdStrike is investing heavily in R&D for agentic AI security—every AI agent needs protection. Conservative DCF shows double-digit upside. The Salesforce partnership and global expansion through Falcon create real competitive advantages."

The Valuation War

Julian Lin (36K Followers, Growth Stock Expert — Sell): "The market's asleep on deceleration. Growth is slowing, and seat-based pricing limits AI upside versus usage-based competitors. At 28x sales, even optimistic projections imply minimal returns. Multiple compression is coming—find bargains elsewhere."

Parkev Tatevosian (CFA, Finance Professor — Hold): "I've held this position almost all year at hold. My DCF model shows intrinsic value at $299—the stock trades at $470. That's a forward P/E of 120x. Yes, they're a leader, but this is my least favorite cybersecurity stock purely on price."

Macquarie Research (Steve Koenig — Neutral, $485 Target): "The concern is simple: 20x enterprise value to revenue is pretty rich. They need time to grow into this valuation. We're not bearish on the business—just realistic about what's already priced in."

The AI Opportunity

Michael Del Monte (5.9K Followers, Buy-Side Analyst — Buy): "Strategic acquisitions like Onum and Pangea are building an agentic AI moat. Every company deploying AI agents faces new attack surfaces. CrowdStrike's Charlotte AI platform makes security automated and intelligent. Financial flexibility supports continued innovation."

Yiannis Zourmpanos (12.6K Followers, Tech Pattern Spotter — Buy with Caution): "The Falcon Flex model is brilliant—over 75% utilization driving rapid upsells. Net new ARR is accelerating through platform consolidation. But revenue growth is slowing, and valuation leaves zero room for execution errors. One miss triggers a bloodbath."

The Outage Hangover

Gary Alexander (32.5K Followers, Tech/Wall Street Veteran — Hold, Downgrade): "After that July outage, clients are hyperaware of update risks. Competition from Zscaler, Palo Alto, and SentinelOne is intensifying. Trading at 27x revenue and 148x P/E after a massive run-up? Time to take chips off the table until FY27 visibility improves."

Rogerio Adelino (CFA, Ex-CFO — Buy): "That incident was painful, but gross margins and growth remain intact. Cybersecurity is structurally expanding—attacks aren't decreasing. Post-incident, margins are recovering, and the company's positioned in an unavoidable business. Long-term potential justifies the premium."

The Street's Verdict

Rick Orford (Trading Since 1999 — Bullish but Risky): "CrowdStrike has upside, but this isn't for risk-averse investors. They're innovating fast, moving toward profitability in an essential market. Just understand—at these valuations, you need a strong stomach for volatility."

Dhierin Bechai (Defense/Tech Analyst — Buy): "They crossed $1 billion in subscription revenue. That recurring revenue engine compounds as new client wins accelerate. There's still upside as the platform effect builds and cross-selling deepens."

The J Thesis (Institutional Asset Management — Hold): "Future looks bright, but the stock already knows it. Every positive catalyst is priced to perfection. Wait for a better entry unless you're buying for 5+ years."

Investor Takeaways

The Business:

Revenue: $1.17B quarterly (up 21%)

ARR: $4.66B (record high)

Net loss: $0.31/share (stock comp + operating expenses)

Revenue CAGR: 68% over the past decade

Valuation:

Current: ~$470

Analyst targets: $299 (bear) to $495 (bull)

Forward P/E: 120-125x | Price-to-Sales: 26x

Peer comparison: Qualys 8x, Varonis 12x sales

Bulls See:

AI agent security (Charlotte AI) is a massive opportunity

Identity security expansion—huge addressable market

Platform consolidation is driving upsells via Falcon Flex

Market leader with the strongest brand despite the outage

Bears Warn:

Priced for absolute perfection at 125x earnings

Still posting net losses amid ballooning expenses

July 2024 outage damaged the reputation permanently

DOJ/SEC investigating $32M channel deal irregularities

Growth decelerating as the base gets larger

I see CrowdStrike as the best business at the worst price.

The bull case is legitimate: they're the category leader, the AI security angle is real, and every company needs cybersecurity. The platform expansion and recurring revenue model work.

The bear case is math: you're paying 125x future earnings for a company posting losses with slowing growth. One guidance miss, another outage, or regulatory action sends this down 30% overnight.

My stance:

If you're long-term focused: Wait for a 20%+ pullback to $375 before starting a position

If you own it: Consider trimming 30-50% here, let the rest run with a tight stop at $450

If you're value-oriented: This isn't your stock—find cheaper cybersecurity plays

Bottom line: CrowdStrike could dominate AI security and reward patient investors—or teach everyone why valuation matters. The business is excellent, but excellent businesses become terrible investments at the wrong price.